Introduction

Rethinking Insolvency Laws in the Malaysian Context

“Neither a borrower nor a lender be, for loan oft loseth both itself and friend. and borrowing dulls the edge of husbandry.” (William Shakespeare, in Hamlet Act1,Scene 3, Line 75). However in any modern economy borrowing and lending are inevitable. Where financial opportunities exist and ready credit is available, both individuals and companies take on financial commitments and risks in order to expand their businesses. Nevertheless problems traditionally arise when people are incompetent in business or just simply unlucky as when the economy goes into recession, interest rates go up or business projections do not match performance, or unexpected situations affect their ability to repay as for instance the victims of natural disasters who would not have factored such calamities into their financial planning etc. (Michael Murray (2005). This is where insolvency laws step in to deal as equitably as possible with the competing claims of creditors and the legitimate needs of the debtors. The World Bank “Principles for Effective Insolvency and Creditor Rights Systems (Principles)” and the UNCITRAL “Legislative Guide on Insolvency Law (Legislative Guide)” were developed in 2001 in response to the financial crisis in emerging markets in the late 1990s.(Global Insolvency Law Database). They constituted the first internationally recognized benchmarks to evaluate the effectiveness of domestic creditor rights and insolvency systems. In 2005 the ‘Principles’ were revised. The World Bank and UNCITRAL, in consultation with the IMF, prepared the Insolvency and Creditor Rights Standard for ICR ROSC assessments (the “ICR Standard”). The ICR Standard combines both the ‘Principles’ and the ‘Recommendations’ in one document (World Bank and UNCITRAL – 2005).

The recent public ‘bail outs’ of big American companies such as American International Group (AIG), Ford, General Motors and Chrysler in 2008 (Edmund L. Andrews -2008) and again of ‘Fannie (Federal National Mortgage Association) and Freddie (Federal Home Loan Mortgage Corporation) by the American government raised a huge outcry among the American public (Carol J Perry – 2009). These and other similar events have set in motion a rethinking of insolvency laws. The United Nations Commission on International Trade Law (UNCITRAL) Model Law on cross border insolvency recommends a single insolvency procedure to facilitate harmonisation of international trade laws.

This paper shall be focusing on calls for reform in the area of personal insolvency as well as corporate insolvency with reference to Malaysia. In the 2011 Malaysian budget announcement, made on 15 October 2010 (Budget 2011), it was stated that the recent economic crisis saw a number of businessmen and individuals with financial problems being declared bankrupt. They were also blacklisted and were not able to apply for loans or conduct businesses. To help these individuals, a new Insolvency Act is being mooted planning to consolidate the Bankruptcy Act 1967 and Part 10 of the Companies Act 1965. It plans to introduce relief mechanisms for companies and individuals with financial problems as well as reviewing the current minimum limit for bankruptcy.

Objective of Insolvency Laws

Insolvency is a general term used to describe a debtor’s legally declared inability to pay debts as they fall due. When this happens most legal systems provide for a legal mechanism to address the collective satisfaction of the outstanding claims from the debtor’s assets. In the case of an individual, the mechanism is referred to as bankruptcy proceedings, whereas in the case of a limited company or corporation, it is referred to as company liquidation or winding-up.

The objective of insolvency law is (Michael Murray-2005):

- To provide an equal, fair and orderly procedure in handling the affairs of debtors ensuring that creditors receive an equal and equitable distribution of the assets of the debtor;

- To provide procedures which ensure that debts are satisfied with minimum delay and expense;

- To ensure that the administration is conducted in an independent and competent manner;

- To provide mechanisms for the treatment of the debtor before his position becomes hopeless;

- To provide procedures which provide for both debtors and creditors to be involved in the resolution of the insolvency problem;

- To ascertain the reasons for insolvency and provide mechanisms for the examination of the conduct of the debtor, their associates and officers of corporate debtors. This is to maintain commercial ethics;

- To provide for the vesting of all the debtor’s property and assets in the Director General of Insolvency and to develop a plan that allows a debtor to resolve his debts through the sale of the debtor’s assets and equitable distribution of the proceeds among his creditors according to their rights;

- To enable a debtor to make a fresh start as soon as he is discharged by a court.

Sources of Insolvency Laws in Malaysia

In Malaysia insolvency is governed by the following statutes (Malaysian Department of Insolvency):-

(i) Bankruptcy Act 1967 (BA), amended in 2003 and the Bankruptcy Rules

(ii) Part X Companies Act 1965 (CA) and Companies Winding up Rules

(iii) Society Unions Act 1966

(iv) Trade Unions Act 1959

This paper shall now examine the case for reform in personal and corporate insolvency separately.

Bankruptcy

The most common causes for bankruptcy in Malaysia have been identified as follows: Bankruptcy statistics for 2009 (Hemananthani Sivanandam – 2010):

- 19,380 cases for failing to settle hire purchase loans

- 9,464 cases for failing to settle personal loans

- 8,786 cases for failing to settle business loans

- 6,022 cases for failing to settle housing loans

- 4,417 cases for failing to settle credit card debts

- 4,291 cases for failing to settle corporate loans

- 3,726 stood as guarantors

Total: 19,380

Bankruptcy involving credit card usage is becoming increasingly worrying to the banks and Bank Negara in particular, the latter having to play moderator between the delinquent credit card holder and the credit card issuer claiming back monies owed.

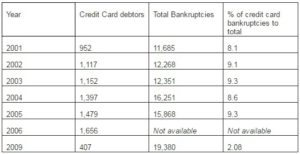

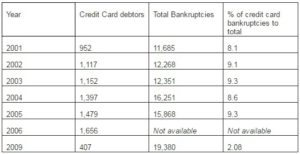

Statistics from Bank Negara for credit card bankruptcies specifically:

Table 1: Statistics from Bank Negara for Credit Card Bankruptcies Specifically

The last quarter century has witnessed a rapid expansion of consumer credit, due notably to the proliferation of credit card lending. The table above shows a steady increase in credit card bankruptcies from 2001 to 2006. However the significant drop in credit card bankruptcies in 2009 was due to tough measures taken by the government, such as introducing an annual service charge RM50/- for each principal credit card and RM25/- for each supplementary card owned (Budget 2011). Further plans include restricting the number of credit cards owned by each consumer, increasing the annual income level eligibility from the current RM18,000/- to RM24,000/-( The Sun – 2011) The Malaysian Department of Insolvency also played an active part in restructuring loans. Although 2009 saw a drop in bankruptcies, statistics, as of June 2010 show that the total number of registered bankrupts in Malaysia was 218,561(Bernama – 2009), an alarming increase, despite the stringent measures taken.

The Malaysian BA 1967 was amended in the year 2003 and came into force on 1 October 2003. The objective was to keep abreast with international changes in the law relating to insolvency. In this respect a unitary approach to the administration of insolvency was taken although the legislation remains separate.

Changes brought about by the 2003 amendments include:

- s.2 A change in the title of the Official Assignee Malaysia to the Director-General of Insolvency Malaysia (DGI);

- s.2 Inclusion of a definition of ‘social guarantor’ i.e. one who stands as a guarantor for loans like education, house, car hire purchase, scholarship and also third-party loans;

- s.5(3)A requirement for a petitioning creditor to prove to the Court that he or she had exhausted all avenues to recover debts owed to him or her by the debtor before he or she can commence any bankruptcy action against a ‘social guarantor’.

- s.5(1)(a) An increase in the minimum debt which enables a person to be declared bankrupt from RM10,000/- to RM30,000/-;

- S.33B Enabling the DGI to give the creditor a notice of his or her intention to issue a certificate of discharge to a bankrupt without having to give any reason;

- Sch. C(24) Stopping the calculation of the rate of interest on the date of the receiving order granted by the court in cases where the interest is not reserved or agreed upon;

- s.84A Conferring powers of a Commissioner of Police to the DGI and the powers of a police officer on the investigation, officers to facilitate investigation, prosecution and enforcement;

- s.109(1)(m)(i) An increase from RM100/- to RM1,000/- as the maximum amount that can be borrowed by an undischarged bankrupt without informing the person who gives the credit or loan that he is an undischarged bankrupt.

- According to a study conducted by the Asian Banker Research, Malaysia is listed fourth in the Asia Pacific region’s most creditor-friendly bankruptcy regimes where creditors can expect to recover more than 80 cents in the dollar of assets they are owed ( Bernama – 2009). Recovery takes on average 2 years (The Sun – 2010)

Some suggestions for further reforming the bankruptcy regime would be to:

(i) raise the current minimum threshold for bankruptcy from of RM30,000/- to RM50,000/-,

(ii) discharge by the Director General of Insolvency from bankruptcy after 2 years,

(iii) allowing bankrupts to do some small businesses and/ or be gainfully employed to speed up the discharge process,

(iv) issue directives to banks to provide financial counseling before the granting of credit,

(v) credit extended should not extend beyond the card holder’s monthly earning

(vi) suspension of credit card facilities by card issuers upon debtor defaulting in credit repayments for 3 consecutive months. Credit card issuers should not be permitted to continue extending credit to such debtors as a means of raking in profits through the continuing interest and penalties. Interest is the ‘killer’ element which leads to unmanageable debts for most people.

Corporate Insolvency

The Malaysian Companies Act 1965 s. 211 provides for three different procedures under liquidation: voluntary liquidation which could be a members’ voluntary winding up of a solvent company or a creditors winding –up where a company is unable to pay its debts and compulsory winding-up by the court. Statistics from the Malaysian Insolvency department shows a disturbingly increasing rate of corporate insolvencies(Carol J Perry – 2009).

Table 2 : Corporate Insolvencies

Some of the general objectives of corporate insolvency law are (RM Goode – 1990):

- The facilitation of the recovery of companies which are in financial difficulties;

- The suspension of legal actions by individual creditors through the creation of a moratorium;

- The removal of powers of management of the company by its directors, even if directors retain their position as directors;

- The avoidance of transfer and transactions which unfairly prejudice the general body of creditors;

- Ensuring that there is an orderly distribution of company’s assets;

- The provision of a fair system for the ranking of claims against the company;

- Making provisions for the investigation of the company’s failures and the imposition of liability of those responsible for the failure;

- The protection of the public from directors who might in future engage in improper trading;

- Maintaining the ethical standards and competence of insolvency practitioners;

- The dissolution of a company at the end of the liquidation process.

Unlike the bankruptcy laws, Malaysia’s corporate insolvency laws have not undergone major changes. The Corporate Law Reform Committee (CLRC) established in 2003 under the Companies Commission of Malaysia (CCM), undertook various cross jurisdictional benchmarking studies of jurisdictions that have a similar corporate framework as Malaysia such as the United Kingdom, Australia, New Zealand, Singapore and Hong Kong. The CLRC reports that the present insolvency framework is very much focused on the liquidation or winding up of a company. Liquidation has also often been seen as the only viable option for companies which are insolvent.

However, the new approach in corporate insolvency is corporate rescue, as seen in the Fannie and Freddie cases mentioned above. Liquidation or winding up is no longer considered as the main outcome of an insolvent company. The modern corporate insolvency framework in many jurisdictions cover matters pertaining to pre-insolvency procedures, liquidation process, consolidation of corporate and personal insolvency laws and corporate rescue mechanisms. There are obvious benefits that come about with a successful restructuring plan, employees keeping their jobs, suppliers maintaining their business relations, customers continuing their business and the preservation of the community etc. Though these may be by-products of the maximization of creditors’ returns and not a reason in itself to undertake restructuring of a debtor company, they nevertheless demand serious economic considerations (Karma Dolkar – 2010).

The CLRC established 4 working groups. Group D was given the task of studying the current corporate insolvency regime and recommending reforms. The main objective of the study is to review and propose a legal and regulatory framework that would:

- enable companies that could not continue its business as a going concern to be wound up in an efficient manner;

- enable companies that are facing financial difficulties, but where there is a business case for the continuation for the company’s business, to be restructured.

Their Report is discussed below.

Legislation

Although both personal insolvency and corporate insolvencies have since 2003 been administered by the department of Insolvency under the Director General of Insolvency they are governed by separate statutes, the Bankruptcy Act 1967 and Rules and the Companies Act 1965 and Winding –up Rules 1972. The Malaysian Budget 2011 has proposed a single Insolvency Act as in the UK and New Zealand. The CLRC finds that the current corporate liquidation or winding up framework is confusing due to the fact that there is extensive cross-referencing made to the various bankruptcy principles and rules provided for in the Bankruptcy Act 1967. eg. the application of s. 53 BA1967 under s. 293 CA 1965 for undue preference transactions

Methods

Presently, creditors appoint a Receiver, use up the profits and sell off the assets or apply to court for a scheme of arrangement and reconstruction. The CLRC finds these measures inadequate, as there is a lack of focus on rescue mechanisms or attempts to rehabilitate companies. Liquidation should be combined with corporate rescue packages to achieve commercially realistic goals.

Causes of business failure

These are basically two. Corporate mismanagement or factors beyond their control e.g. temporary financial difficulties or external economic factors. The CLRC recommends that where it is due to

(i) mismanagement, the relevant persons should be made accountable and prevented from setting up new companies;

(ii) factors beyond control, the DGI should advise on corporate restructuring and rescue mechanisms.

Commencement of Winding up

Currently s. 219 (2) stipulates the commencement of winding – up to be from the date of filing of the petition for winding- up in court.

The CLRC recommends that the effective date of commencement should be amended to the date the order of court for winding –up is made. Creditors anxieties regarding dissipation of the assets by the company as under sections 223, 224, 293, 294 and 295 could be addressed with appropriate amendments delinking them from s.219(2).

s.223 states that all dispositions of the company’s assets after the presentation of the winding up petition are void, unless these are validated by the court. This procedure is cumbersome and expensive. This could be amended by providing a list of exempt dispositions which are exempted from the requirement of a court validation order. This will provide certainty and be more cost effective as it will ease the burden faced by companies.

s.293 relates to undue preference i.e. an advantage obtained by one creditor over the others. Currently it is not clear whether the liquidator has to prove intention (Sime Diamond Leasing (M) Sdn Bhd.- 1998). Further it is complicated by cross references to s.53 BA 1967.

The CLRC instead recommends that s 293 be:

(i) “effect-based” i.e. a voidable transaction can be set aside based on its effect, regardless of the intention, motive, or knowledge of the debtor or the recipient of the transaction. Towards this end, a list of undue preference transactions modeled after the New Zealand provision, but with modifications as to the time frame could be introduced.

(ii) the cross referencing to the BA should be deleted The list for undue preferences should be clarified as follows :

- a conveyance or transfer of property by the company;

- the giving of a security or charge over the property of the company;

- the incurring of an obligation by the company;

- the acceptance by the company of execution under a judicial proceeding; and

- the payment of money by the company, including the payment of money under a judgment or order of a court.

(iii) As for time the frame, s 292 of the New Zealand Companies Act 1993 has two different time periods:

- transactions occurring within the specified period of two years of formal insolvency;

- transactions occurring within the restricted period of six months of the formal insolvency.

The two different time frames (which are similar to the Malaysian bankruptcy provisions sections 53 and 54 BA) have been the subject of review by the New Zealand Insolvency Law Review (NZILR) as they were often criticized as being arbitrary and lengthy (New Zealand Ministry of Economic Development (2006).

As for Malaysia, the CLRC recommends the following time frame:

- in the case of a compulsory winding up, the time frame should be within six months from the date of the presentation of the petition;

- where prior to the presentation of the petition, the company passed a resolution to voluntarily wind up the company, the six month period shall commence from the time when the resolution was passed.

- in the case of a voluntary winding up, the time frame should be within six months from the date upon which the voluntary winding up is deemed to have commenced.

s.294 relates to floating charges. The CLRC recommends that in the case of a compulsory winding up, a floating charge shall be voidable at the option of the liquidator if it was created within 6 months of the presentation of the petition for compulsory winding up.

s.295 relates to the Liquidator’s right of recovery. The CLRC recommends:

(i) that s. 295 be amended to allow the liquidator, in a compulsory winding up, to set aside transactions coming under the section if these were entered into within 2 years from the date of the presentation of the petition or from the date the company passes a resolution to voluntarily wind up the company, whichever is earlier;

(ii) that the liquidator, in a voluntary winding up, can set aside transactions coming under this section if these were entered into within 2 years from the date upon which the voluntary winding up is deemed by this Act to have commenced; and

(iii) that section 295 be amended to extend its application to ‘persons connected to directors’ and to ‘substantial shareholders of the company

Presumption of Inability to Pay

Currently the minimum threshold under s.218(2) is only RM500/-

The CLRC recommends:

(i) increase of the liquidated amount from RM500 to RM5,000. This will prevent abuse by creditors in resorting to winding – up over trivial claims;

(ii) introduction of a time frame within which a petition to wind up a company should be filed. The proposed time frame is 6 months after the expiry of the statutory 21 day period to comply with a notice of demand. Upon expiry of the time period creditors may issue a fresh 21 day notice without having to resort to leave of court.

Terminology for Liquidator

Currently, s231(4) merely states that the court may appoint the Official Receiver or an approved liquidator provisionally..

The CLRC recommends that s 231 be amended as follows:

“the court may appoint the Official Receiver or an approved liquidator as interim liquidator at any time after the presentation of a winding up petition and before the making of a winding up order…”

Powers of the Liquidator / Receiver

Currently, the powers and duties of the liquidator are not clear. There are issues pertaining to

- the need for approval from a committee of inspection for the appointment of an advocate and solicitor,

- powers to compromise debts under s. 236(2)(b),

- s.238(2) limitation of period of trading to 4 weeks, retention amount of RM200/- and a time frame for retention of 10 days,

- s.234 duty of Company secretaries to submit a statement of Affairs, and

- s.224 for the liquidator to submit a list of Contributories.

The CLRC recommends as follows:

(i) delete the requirement for the prior approval of the court or the Committee Of Inspection for the appointment of an advocate; that a liquidator be empowered to compromise debts owed to the company if the amount is less than RM10,000 and this power should be exercisable without the having to obtain the sanction of the court;

(iii) that the court or the Committee Of Inspection be given a discretionary power to give a blanket approval to liquidators to compromise debts within the range of RM10,000 to RM50,000 and this power should be exercised on a case by case basis;

(iv) that the existing time frame for a liquidator to trade after the winding up order has been made be extended to six months, after which the liquidator be required to obtain the sanction of the court;

(v) that section 238(2) of the Companies Act 1965 be deleted.

(vi) that section 234 of the Companies Act 1965 be amended by deleting the requirement for company secretaries to submit statements of affairs;

(vii) that the current mandatory requirement to settle a list of contributories be amended to make it discretionary for the liquidator to settle the list of contributories if there:

should be surplus capital for distribution or

if there should be contributories who are likely to contribute their unpaid portion of capital.

(viii) the powers of the liquidator/ receiver should be codified in the CA;

(ix) the Receiver should be personally liable for debts incurred by him or his authorised agents during his tenure of office, unless there is a specific agreement to the contrary between the contracting parties;

(x) notwithstanding the personal liability of the Receiver, he should be entitled to be indemnified out of the assets of the company which are charged under the debenture pursuant to which the receiver is appointed; and

(xi) the receiver’s cost and remuneration should be given priority over all claims by other creditors.

Rights of Secured Creditors

Currently, the rights of secured creditors and the rights of creditors to mutual credits and set-off are dealt with by case law which gives them priority over the unsecured creditors. They are not statutorily provided for under the Companies Act. Jurisdictions such as New Zealand and Australia have codified these rights.

The CLRC recommends that the rights of the secured creditors, in respect of charged assets should be clearly stated in the Companies Act and recommends the adoption of section 305 of the New Zealand Companies Act 1993 as a model for such a provision. There should be a corollary provision to reflect this in the Companies Winding –up Rules 1972 as well.

As for the right to set-off, the CLCR recommends that it should not only be limited to contributories, but should be extended to creditors of the company in the case of mutual debts for both solvent and insolvent liquidations. They further recommend incorporating the UK provisions that the right to set- off should not apply where the creditors “have notice at the time the sums owing became due that a meeting of creditors has been summoned or a petition for winding-up is pending,”

Proof of Debt s.291

Presently, these are subject to cross-referencing under the BA. The CLCR recommends that the cross references be deleted but the provisions relating to proof of debt and priority of creditors be specifically set out in the CA.

Preferential Debts s.292

The CLCR recommends amending certain provisions in relation to preferential debts.

They recommend:

(i) abolishing the preference given to any unpaid taxes to the in the event of winding-up;

(ii) increasing the current amount of salaries and wages of employees from RM1,500/- to RM15,000/- in line with other jurisdictions like Singapore, Hong Kong and Australia; and

(iii) a new definition for ‘wages and salaries of employees’ to include ‘payment in lieu of notice of termination of employment’.

Termination of winding-up

Currently no clear provisions exist. The courts generally grant a stay of winding-up which can have a permanent effect.

The CLRC recommends:

(i) that the court be given the power to terminate winding up proceedings on the application of a relevant party; and

(ii) that an application to terminate winding up proceedings may be made by a liquidator, or a director or shareholder of the company or any other entitled person or a creditor of the company, or the Registrar.

Deregistration of a Company s.308

New guidelines had been issued by the Companies Commission Malaysia (CCM) on 12 January 2007. Under these the directors and shareholders (but not a company secretary) of a defunct company are allowed to apply to strike out the name of the company under s. 308(2) and a liquidator under s. 308(3).

Corporate Rehabilitation Framework

In keeping with current international trends, and in particular with provisions in the UK, Singapore and Australia, the CLRC has proposed a framework incorporating the following features:

(i) a clear framework for rehabilitation that is easily understood and implemented;

(ii) a realistic time frame within which the proposal is to be prepared, approved and implemented;

(iii) a moratorium period to enable the proposal to be formulated and implemented without the threat of liquidation or creditors’ action that may frustrate the rehabilitation process;

(iv) provisions to safeguard creditors’ interest by adequately providing for creditors’ voting rights and the right to receive reliable information concerning the company and the rehabilitation plan;

(v) the involvement of qualified insolvency practitioners to ensure that the process would be impartial and there would be no unnecessary delay in the process; and

(vi) the court’s involvement in the initiation, implementation and supervision of the rehabilitation plan to ensure fairness in the process and to ensure that the rights of any particular class are not prejudiced.

Judicial Management

The CLRC recommends the introduction of two new corporate rehabilitation schemes, novel for Malaysia, namely the Judicial Management System (JMS) and a Corporate Voluntary Arrangement (CVA). These will complement the existing provisions s. 176 CA which enables a financially distressed company to restructure when there is a business case for it to continue its operations.

A JMS is initiated by an application made by a company or a company’s creditors to place the management of a company in the hands of a qualified insolvency practitioner known as a Judicial Manager. The Judicial Manager, once appointed by the court, will prepare a restructuring plan, acceptable to the majority of the creditors. Once approved by the creditors and sanctioned by the court, the plan will be implemented.

The CLRC recommends that the court should be empowered to make a judicial management order in relation to a company if it is satisfied that the company is or will be unable to pay its debts as per s.218(2) and it considers that the making of the order would be likely to:

- achieve the company’s survival on the whole or in part ; and

- enable a more advantageous realisation of the company’s assets than in a winding up.

The CLRC recommends that parties who may be entitled to apply for a judicial management order be the company or its directors (pursuant to an ordinary resolution of its members or a resolution of the board of directors) or a creditor or creditors of the company (including prospective and contingent creditors).

However, the court should not make the order if:

a receiver and manager has been or will be appointed or the making of the order is opposed by a person who is entitled to appoint a receiver and manager, e.g. a debenture holder; or

- the company is in liquidation or the company is a bank or a finance company or an insurance company licensed under the relevant Act.

- To this end, notice should be given to all relevant parties, i.e. the company, creditors, debenture holders, any person who has appointed or is entitled to appoint a receiver and manager of the company’s property

Once a judicial management order has been made, an interim judicial manager may be appointed by the court. During the period of the judicial management order

(i) no resolution should be passed or order made for the winding up of the company;

(ii) no steps should be taken to enforce any charge or security over the company’s assets without leave of the court;

(iii) no proceedings against the company should be commenced or continued without leave of the court.

(iv) with the exception of companies listed on the Malaysian Stock Exchange, any transfer of shares or any alteration in the status of members of a company during the moratorium period shall also be void unless the court otherwise orders;

(v) the judicial manager should be given a moratorium of 180 days to table a proposal to creditors, and where appropriate the court may grant an extension of time to the judicial manager to do so, but the maximum duration of the moratorium should be one year after the order appointing the judicial manager is made;

(vi) utility suppliers such as Tenaga Nasional Berhad, Telekom, etc. should be obliged to continue to provide supplies so long as new debts incurred by such a company are paid;

(vii) no steps be permitted to be taken to commence or to continue the enforcement of a sale of land of such a company under the National Land Code except with the leave of the court

(viii) to enact a statutory provision that the limitation period shall not run with respect to any cause of action against a company in relation to which a judicial management order has been made during the moratorium period and that the moratorium period should be excluded for the purpose of calculating the limitation period.

Creditors Rights and Voting by Creditors

The CLRC recommends that:

(i) at a creditors’ meeting convened to consider a proposal tabled by the judicial manager, there should be a 75% majority in value of creditors present, voting either in person or by proxy, whose claims have been accepted by the judicial manager, to approve the proposal with modifications, subject to the judicial manager’s consent to such modification.

(ii) any secured creditor be given the right to oppose the petition or application for a judicial management order.

(iii) once the judicial management order has been made the secured creditors should not be permitted to realize their security. The judicial manager should have the power to deal with the charged property of the company as if the property were not subject to any security.

(iv) the introduction of an express statutory provision that once the proposal is approved, it shall be binding on all creditors of the company whether or not they have voted in favour of the proposal.

(v) the judicial manager should be required to report the results of the creditors’ meeting to the court and to notify the Registrar of the same. In addition, the decision of the creditors’ meeting should be

(vi) advertised in the national daily newspapers, at least one in English and one in Bahasa Malaysia( the national language of Malaysia).

(vii) creditors should be able to bring an action for relief against oppressive conduct if the court is satisfied that the company’s affairs, property or business are being or have been managed by the judicial manager in a manner which is or was unfairly prejudicial to the interests of its creditors or members generally or to some of them.

Discharge of the Judicial Manager

The CLRC recommends that the judicial management order should be discharged if the:

(i) proposal has not been approved by the requisite majority in the creditors’ meeting. Where consequently the court orders the discharge of the judicial manager, it should also be entitled to discharge the judicial management order and make such consequential provision as it thinks fit, or adjourn the hearing conditionally or unconditionally, or make an interim order or any other order that it thinks fit;

(ii) purpose of the judicial management has been successfully achieved;

(iii) judicial manager is of the view that the purpose of judicial management is unachievable;

(iv) judicial manager applies for a discharge, or is no longer qualified to be a judicial manager or is removed from office, unless the court makes an order replacing the existing judicial manager.

The Role and Functions of the Judicial Manager

The CLRC recommends that :

(i) the powers of the judicial manager as provided in s. 227G of the Singapore Companies Act (Chapter 50), be adopted and expressly stated in the CA;

(ii) the judicial manager should be deemed to be the agent of the company during the period of judicial management;

(iii) the judicial manager should be given control over the affairs, business and property of the company during the judicial management period.

(iv) the suspension of powers of the other officers of the company during the judicial management period unless written approval is obtained from the judicial manager;

(v) the company secretary should submit the statement of affairs to the judicial manager;

(vi) a judicial manager should unless he disclaims liability, be personally liable on contracts he enters on behalf of the company;

(vii) a judicial manager should be indemnified in respect of his liabilities, remuneration and expenses, out of the assets of the company in priority to all other debts except those subject to security of a non-floating nature;

Corporate Voluntary Arrangement (CVA)

The CLRC recommends the introduction of a statutory CVA scheme similar to that of the UK with modifications to suit local needs. A financially distressed company may now opt to initiate a rehabilitation scheme by itself through the appointment of a qualified insolvency practitioner who will supervise the implementation of this scheme.

The main features would be:

(i) unlike in the UK, this shall be available to both small and large companies in Malaysia;

(ii) a moratorium period shall be automatically applicable upon the filing of the relevant papers in court;

(iii) a moratorium of up to 60 days shall be applicable with the consent of the creditors and the insolvency practitioner;

(iv) a scheme to be approved shall require a majority of 75% of the creditors who may vote either personally or by proxy;

(v) the court’s involvement in a CVA shall be limited to hearing challenges to the scheme based on material irregularity, prejudice or an ineffective scheme;

(vi) if there is to be a challenge it should be made within 28 days of the CVA report being submitted to court;

(vii) the management of a financially distressed company under CVA should remain with the directors;

(viii) a qualified insolvency practitioner be appointed to assess the viability of the proposed CVA scheme between the directors and the creditors; and

(ix) despite the moratorium under the CVA, the companies and securities market regulators should not be prevented from commencing any enforcement actions to ensure compliance of corporate and/or securities law or guidelines thereunder.

Conclusion

There is a discernable change in attitudes towards insolvency, either at the personal level or the corporate level. The Malaysian government appears to be waking up to the fact that insolvency has a detrimental effect on the economy and society as a whole. The present thrust of efforts in reforming insolvency laws, is, on the one hand, to rehabilitate the ‘honest but unfortunate’ debtor and on the other improve efficiency and integrity of the insolvency mechanism. It seeks to clarify and streamline the law and improve returns to creditors by giving them a greater role in insolvency proceedings. Towards this end bankruptcy laws have undergone drastic amendments with more practical efforts underway. The major area for reform is in the corporate sector and the recommendations made by the CLRC with its focus on improving efficiency and giving rehabilitation a chance will, if adopted, bring Malaysia’s insolvency laws on par with the UNCITRAL Model law.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Bank Negara Malaysia Annual Report 2005

Publisher – Google Scholar

Bernama Thurs. 8 Jan. 2009. Avilable online: http://www.malaysianbar.org.my/legal/general_news/malaysia_creditor_friendly_bankruptcy_

regime.html?date=2009-09-01 [Accessed on 3 Feb. 2011].

Budget 2011. Available online: http://www.sc.com.my/eng/html/resources/budget2011/2011_BudgetSpeech.pdf [Accessed on 3Feb. 2011]

Corporations Act 2001. Available online: http://www.comlaw.gov.au/Details/C2011C00013 [Accessed on 3Feb. 2011]

Publisher

Corporate Law Reform Committee:Review of the Companies Act 1965, Final Report. Chapter 4 I nsolvency. Available online: http://www.ssm.com.my/en/docs/CLRCFinalReport.pdf [Accessed on 2 Feb. 2011]

Corporate Law Reform Committee:Review of the Companies Act 1965, Final Report. Chapter 4, Insolvency. Available online: http://www.ssm.com.my/en/docs/CLRCFinalReport.pdf [Accessed on 2 Feb. 2011]

Dolkar, K. (2010). ‘Re-Thinking ‘Rescue’ : A Critical examination of CCAA Liquidating Plans,’ Available online: http://www.insolvency.ca/docs/writingAwards/file20101111060008163.pdf [Accessed on 2 Feb. 2011]

Edmund L. Andrews, “Fed in an $85 Billion Rescue of an Insurer Near Failure,” N.Y. Times, Sept. 17, 2008. Available online: http://newstrust.net/stories/26202 [Accessed on 31 Jan. 2011].

Publisher

Fletcher, I. F. (1996). ‘The Law of Insolvency,’ 2nd Edn. Sweet & Maxwell London

Google Scholar

Global Insolvency Law Database, “Principles and Guidelines,” Available online: http://web.worldbank.org/WBSITE/EXTERNAL/TOPICS/LAWANDJUSTICE/GILD/0,,contentMD

K:20196839~menuPK:146205~pagePK:64065425~piPK:162156~theSitePK:215006,00.html [Accessed on 2 Feb. 2011]

Publisher

Gelpi, R. M. & Julien-Labruyère, F. (2000). The History of Consumer Credit : Doctrines and Practices,

St. Martin’s Press Available online: http://books.google.com.my/books [Accessed on 31 Jan. 2011.]

Publisher – Google Scholar

Goode, R. M. (1990). Principles of Corporate Insolvency Law, pp 5-10, Sweet & Maxwell, London;

Publisher – Google Scholar

Harmer, R. W. (1988). “General Insolvency Inquiry,” Report No 45, AGPS Canberra;

Publisher

Malaysian Department of Insolvency. Available online:-

http://www.insolvensi.gov.my/index.php?option=com_content&view=article&id=419&Itemid=571&lang=en. [Accessed on 31 Jan. 2011]

Murray, M. (2005). ‘Keay’s Insolvency: Persoanl and Corporate Law and Practice,’ p 3, 5th. Edn. Thomson Lawbook Co.

Google Scholar

New Zealand Ministry of Economic Development, ‘Latest Decisions’ (4 Jan. 2006) Available online: http://www.med.govt.nz/templates/Page____10823.aspx [Accessed on 2 Feb. 2011]

New Zealand Insolvency Act 2006 S.254 Available online:

http://www.legislation.govt.nz/act/public/2006/0055/latest/DLM385299.html [Accessed 3 Feb. 2011]

Publisher

Perry, C. J. “Rethinking Fannie and Freddie’s New Insolvency Regime” Columbia Law Review Vol.109: 1752 p 1754. Available online: http://www.columbialawreview.org/assets/pdfs/109/7/Perry.pdf [Accessed on 2 Feb. 2011]

Publisher

Sime Diamond Leasing (M) Sdn Bhd v JB Precision Moulding Industries Sdn Bhd [1998] 4 MLJ 569.

Singapore’s Companies Act ( Chapter 50) Available online: http://statutes.agc.gov.sg/ [Accessed on 3 Feb. 2011]

Sivanandam, H. ‘Fewer Bankrupts from Credit Card Debts,’ The Sun 3 Aug. 2010 Available online: http://www.sun2surf.com/article.cfm?id=50205 [Accessed on 3 Feb. 2011]

The Sun ‘Limit on Credit Cards,’ 19 Sept. 2010 Available online: http://www.thesundaily.com/article.cfm?id=51961. [Accessed on:3 Feb. 2011]

UK Insolvency Act 1986 amended 2000. Available online:http://www.legislation.gov.uk/ukpga/2000/39/contents

[Accessed on 3 Feb. 2011]

Publisher

William Shakespeare, in Hamlet Act 1 scene 3, where Polonius advises his son Laertes who is leaving to go to University in Paris.

World Bank & UNCITRAL (2005).”Creditor Rights and Insolvency Standards,” Available online:

http://siteresources.worldbank.org/GILD/Resources/FINAL-ICRStandard-March2009.pdf [Accessed on 2 Feb. 2011]

Publisher