Introduction

Globalization and the development of financial markets, together with the investors’ wish to place their available funds into safe investments, that would generate increasing returns, and with their care towards the truthfulness of financial statements and the operational activity of the companies, caused by the recent economic and financial crisis, have determined the specialization of large financial consultancy companies to provide due diligence services. Through this activity seen by O’Regan as a process of analysis and evaluation of an investment, in the context of company acquisitions, from a financial, legal, and operational perspective, performed by internal or external auditors acting as consultants, an attempt is made to make a real evaluation of the business in order to set a benchmark (O’Regan, 2004).

Moreover, in determining the value of a company, an essential aspect is determining the manner in which it is financed, the chosen strategy (based on credit policies, on self-funding, or through its capital market), determining operational and financial results that will ensure the continuity of the company within a predictable time horizon, without it to liquidate or to significantly reduce its activity (IASB, 2009).

At the same time, the average and long-term financing of the company must be correlated with its activity field, with its specific life cycle as well as with the other economic and financial factors (the fiscal policy imposed by authorities, the business environment, the market share owned).

The present article aims thus to quantify the effect of the financing strategies considered by listed companies quoted in the Bucharest Stock Exchange (BVB) on their value, within the due diligence process, as well as to identify the factors that determine the decision concerning the financing strategy (for evaluating the company’s profitability and its ability to generate future cash flows).

Literature Review

From the perspective of the agency theory, initially suggested by Watts and Zimmerman, a company is seen as the result of one or several contracts, having a determined value / price, as a consequence of interest groups – the main agents – face to face (Adams, 1994). Based on these relations, the agents (represented by managers) want to obtain benefits from the principals (creditors, investors, shareholders, employees), benefiting at the same time from a series of privileged information concerning the company’s ability to pay its interests and refund its contracted credits, or to pay its shareholders by issuing dividends, to make new investments or to extend its production capacity (Hayes et al. 2005). In this context, in order to reduce this informational asymmetry and to be able to trust the company’s financial and non-financial statements presented by managers, the principals (in this case, the potential investors) resort to the services of financial consultancy companies, for the provision of the due diligence mission.

The Approach of the Due Diligence Mission in Evaluating the Company’s Value

In the current economic context, based on the principles of corporate governance, the role of the due diligence mission in establishing the company’s value is more than necessary, even imperative. Such a mission gives meaning to the economic environment, makes it responsible and brings real value to the front scene, which will lie at the basis of negotiating the sales-purchase price of the company. Therefore, classically, the due diligence mission assists managers in establishing the exact price of a company for merging, acquisiting, or making joint ventures, by verifying, validating, and analyzing the available data (Spedding, 2009).

The origins of such a mission can be found as early as 1933, after the adoption and application of the Securities Act, section 11(b) (3), which offers a legal frame for the persons who made investigations included in the prospects concerning issuing new titles (Spedding, 2009). At the moment, this mission aimed to: analyze and evaluate a company or an asset for sale and analyze the financing risk and investigate the general pre-contractual requests for tenders.

Known in francophone literature as the phrase of l’audit d’achats (acquisitions audit), this process implies ensuring the person who wishes to acquire a company or a part of it that the assets presented in the balance sheet are properly evaluated and do not make the object of litigations, that there are no potential risks or obligations that would determine the reduction of the value or of the right to use the company’s assets, and that the investment project desired to be achieved (from the perspective of acquiring the company) is viable, and will generate subsequent benefits.

From a methodological perspective, this type of mission is concerned with issues related to the analysis of the company’s strategies, to its operational performance, to revising its financial statements and fiscal declarations, as well as to evaluating the company in order to determine its global value (including the analysis of the financial structure) (McGee and Byington, 2009).

In this mission, of the main elements subject to acquisitions audit, the following is mentioned: the totality of the assets, labor and service provision contracts (in what concerns legality as well as a series of efficiency and performance criteria), customers (localization and reliability), employees (at the level of the legality of the labor contracts, salary deductions), environmental issues (complying with the legislation in the field), financing (the considered strategies, associated costs, optimization), operations in foreign currencies, issues related to production and supply, fiscal problems (Spedding, 2009).

As a work methodology, the due diligence mission aims to evaluate the financial performance of the analyzed company and to analyze the production process, the market share and the employees. Often, this process starts with the application of a questionnaire by the consultant company, and continues with obtaining information on the analyzed company and with revising the financial reporting documents, and based on the information obtained, it will be possible to identify a reference price, which will allow the completion of the deeds of conveyance of the company.

From the point of view of the purpose of this mission, the most important beneficiaries of the due diligence process are the shareholders, the investors as well as the users of the financial-accounting information. The main aspect that they aim to is to obtain a faithful image concerning the analyzed company, its value, the compliance with the legislation in the field, including fiscal regulations, as well as to evaluate the extent to which the company will be able to continue its activity in the future and the conditions that will determine its prosperity (Morrison et al., 2008).

Although criticized by some from the perspective of the infringement of the intimacy of the environment of the company subject to the analysis, the due diligence mission is considered to be a necessary evil, by making available to the purchaser the information they need in order to make decisions for the company’s acquisition, as well as in the negotiation of the conveyance price (Emerald Article, 2004).

The Influence of Financing Strategies on the Value of the Company

The way in which the various categories of financial resources are selected and scaled, conditions the fulfillment of the main objective of any economic organization. Also these financial resources determine obtaining of positive financial results and decisively influence the subsequent development of the conditions of its economic, social, and environmental stability. The multitude of financing sources attracts specific rights and obligations that mark the existence and evolution of the entity. In the process of company acquisitions, their analysis and evaluation are essential elements in evaluating the opportune nature of the decision. It is necessary for the rights and obligations that characterize the company subject to the evaluation to be compatible and not to limit the fulfillment of the development objectives followed by investors.

In Vernimmen’s opinion (2005), value creation subordinates any other financial objective. The true efficiency of the investment policy is revealed by the effect it has on the value of the entity. The company develops healthily if it promotes efficient investment projects, from which it can obtain considerable cash flows, as a result of selecting the best combination of financial sources. Therefore, the conclusion that can be drawn is that the financial structure and the cost of capital have an impact on value creation for the shareholders (Mironiuc, 2007).

Modigliani and Miller (1958) launched the debate on the financial structure, stating that, without taxing and in perfect conditions of the financial market, between this organization of capitals and the value of the company there is no direct inter-condition. Although the wave of subsequent scientific papers drawn on this topic has denied this hypothesis, it has not been possible to identify all the factors that determine the optimization of the financial structure. Actually, even the authors of the statement go back to it and, in 1963, they introduced into the calculus the impact of the income tax on the relation between the financial structure and the value of the company (Carp, 2011).

Specialized literature identifies a series of theories that provide explanations and benchmarks concerning the way the financial structure is formed and managed: a construction created to the purpose of generating economic growth for the company, of which two can be distinguished through their analytical depth and applicability area of the suggested concepts.

The trade-off theory claims that companies will try to resort to the mixture of financial sources, specific both to banking and to capital markets, which allows them to achieve a balance between the costs and benefits associated to them (Du & Girma, 2007). According to this theory, companies will make financial decisions that will preserve the relation between debts and shareholders’ equity at the level that gives them maximum value, thus generating an optimal financial structure as well.

Unlike this concept, the pecking order theory, developed by Myers and Majluf, states that in order to cover the working capital, companies will mainly resort to internally generated resources, and only as a second option to those provided by external factors, credits being preferred to issuing new shares (Myers & Majluf, 1984).

Ayyagari et al., (2007) notice the complementary role, in the process of obtaining financial resources, of on-banking financial institutions (credit unions, financial associations, insurance companies), as an informal source, based on the system of interpersonal relations that characterizes the less regulated economic areas.

The permanent conflict that exists between the owners and managers of a company generates significant agency costs. These are represented by potential value losses by the company, borne by the shareholders and caused by the managers’ behavior, who can act in the direction of increasing their own benefits or adopting all the decisions in order to effectively meet the organizational objectives.

The choice of the financial structure is an instrument for reducing the agency costs. Under these circumstances, a high degree of indebtedness may determine increases in the company’s value by constraining and encouraging managers to act mainly to the best interest of the shareholders (Berger, & Bonaccorsi di Patti, 2006).

If companies have the financial resources insured by the capital income and there are few opportunities to use them, managers are tempted to launch into investment projects that are not strictly necessary and that will determine the company’s value and its development perspectives (Koller et al., 2010). When the shareholders of a company are numerous or strongly dispersed geographically, it will be difficult and costly for them to notice such behavior. By contracting debts, the company’s management is forced to adopt a prudent attitude, determined by the need to direct its financial resources, mainly according to a fixed calendar, towards paying off the created obligations. Only after covering them is it possible to consider other investments.

Determining Factors in Selecting an Optimal Financial Structure

The choice of a financial structure able to lead to fulfilling the development and stability objectives, aimed at an organizational level, has represented the subject of numerous studies. It can be stated that there is no universal recipe, as the distribution of the various categories of financial resources depends on a variety of factors that influence the activity of companies, both from an internal perspective and from the external environment.

The hypothesis of the possibility to draw an optimal financial structure at the company level depends on the degree of development of the economic environment of which it is part, as well as on the specific national factors (Lin et al., 2009). In the same direction, Hennessy & Whited (2005) state that we cannot speak of an optimal financial structure independent of the national and local specificity, as well as of the economic conditions specific to the analyzed period.

Mironiuc (2009) considers that in order to choose the financial structure, it is necessary to take into account: the economic development and profitability objectives expected by the company; the structure of the assets; the conditions of the financial market; the fiscal economy; the discipline of the managerial behavior; minimizing the costs associated to the information asymmetry; the bankruptcy costs; the agency costs; the costs related to the loss of the company’s flexibility; the attitude of the credit bidders and of the rating agencies.

Rebel (2008), Delcoure (2007), De Jong et al. (2008) make extended studies on the factors that lie at the basis of the choice of the financial structure (economic environment, activity field, stage of development of the company, dimension, age, profitability, liquidity, degree of immobilization of the assets, etc.) stressing, in relation to its distribution theories, the relations and influences established between the mentioned factors and the degree of indebtedness, as an indicator of the manner in which capital is organized.

La Rocca et al. (2009) point out the connection established between the way in which capital is organized and the business diversification strategies. Companies that perform a complementary diversification (sharing and transferring resources and knowledge from one business segment to another) take a low financial risk and cost of capital. Unlike them, entities that adopt an independent diversification are subject to increased risks, having to increase their degree of indebtedness, in the conditions of this increase, exposing themselves to the possibility not to efficiently use their financial resources.

Research Methodology

This paper aims to analyze and evaluate the influences generated by the financing strategy adopted by the companies quoted in the Bucharest Stock Exchange on the manner in which they build their financial structure, on the value of their business, as a benchmark for the objectives aimed by current or potential investors.

In the due diligence mission, being concerned with establishing the companies’ purchase price, the identification of the existence and the quantification of the intensity of the connections between the various categories of capital and their value acquire significant valences, building up in a true instrument used in this approach. The rights and obligations, the costs and benefits generated by each financing resource, their impact on organizational policies, are decisive elements in evaluating the opportunity to acquire the concerned entity.

At the same time, the study aims to identify the internal factors, specific to the company, that determine the composition of the financial structure, as well as the meaning and intensity of their action on the financial leverage, as its indicator.

The positivist approach, based on a deductive-inductive reasoning, is concerned with the logical construction of the work hypotheses by relating them to specialized literature and validating them using the data analysis methods, specific to statistics as well as the financial analysis. The empirical evidence obtained after a mainly quantitative analysis aims to provide an objective illustration and a natural-scientific explanation of the analyzed phenomenon, in order to know it and the laws that govern it (Smith, 2003).

Development of the Work Hypotheses

Starting from the hypothesis of the need to optimize the financial structure, as a premise for maximizing the value of the company, Philosophov et al. (2005) state that, when the ratio between debts and shareholder’s equity is low, its increase determine an expansion of the value dimension of the entity, through the effect generated by tax reductions. However, if the optimum level is crossed, its value may decrease. Long term debts and shareholders’ equity are the main factors that influence the value of the company, but the study of these connections must be made taking into account the impact of the complementary triggers as well, which are respectively short-term debts and commercial debts.

The effect generated by the specificity of financing sources, respectively of its value, is highly important. The impact of the financial structure on the company’s value is reflected beyond the costs and benefits associated to the internal or external resources. Moreover, between them there is a complementarity connection. Direct financing, by reinvesting profit, may not be considered a financing source per se, but it transmits a signal regarding future development strategies (Rahaman, 2011).

In what concerns the sizing of the company’s value, as a variable used in the analysis models of the impact of financing strategies on it, Mironiuc et al. (2011) performed a study on the pertinence of company evaluation methods in conditions of economic instability. The authors state that the company’s value estimated using the net accounting asset (NAA) method can be considered relevant in presenting a faithful image of the company. Simple and easy to apply, this method does not expose shareholders to the potential risks of the capital market, to the problems and limitations of forecasts or bias and to the relativity of the other evaluation methods.

Therefore, a first work hypothesis considers the following:

H1: The value of the company (expressed as value per share) is significantly influenced by the shaped financing strategy, synthesized through the global financial autonomy ratio, the ratio of term indebtedness, the ratio of short term indebtedness, the commercial debts ratio, and the dividend distribution ratio.

Also, Frank and Goyal (2008) identify, in the study performed on the theories concerning the financing of companies, the activity field of the company, the area in which it performs its activity, as a factor with an important influence on the financial leverage. They notice the need to use this variable in the analysis models of the financial structure because of its increased ability to explain the variations of the financial leverage.

The dimension of the indebtedness degree ratio may reflect the level of the financial risk of the business (Mironiuc, 2006). Companies with a high financial leverage are confronted with an increased probability to become bankrupt. However, in specialized literature, this situation is positively associated with the degree of asset tangibility (Aggarwal and Kyaw,2010). Companies will obtain credits if the weight of the fixed assets in the total assets increases (Karadeniz et al. 2009).

In the decisions referring to the structure of the capital, the level of liquidity has a double impact. Agents with a high degree of liquidity are characterized by a high level of financial leverage because of the short-term possibility for them to pay their obligations on due time. On the other hand, companies with high liquidity may use these resources to fund their own investments (Viviani, 2008).

Financial risk is strongly influenced by the company’s profitability. Smith (2010), Chang et al. (2009), La Rocca et al. (2009) notice the controversial relation established between the financial structure and economic profitability, under the influence of financial theories. According to the pecking order theory, the more substantial the result, the less the entity depends on its debts, as the investment projects are mainly funded based on internally generated resources. Thus, a reverse connection is established between the financial leverage and the profitability of the operational activity. According to the trade-off theory, companies with a high economic profitability prefer indebtedness for the opportunity, provided by this situation, to benefit from a reduction of the costs associated to external resources. Therefore, a positive connection can be identified between the two variables.

Based on the ideas presented above, the second work hypothesis can be formulated as follows:

H2: A series of factors specific to the company, respectively to the activity field, financial autonomy, economic profitability, immediate liquidity, the degree of tangibility of the asset, have a significant influence on the degree of indebtedness, as an indicator of the financial structure.

Target Population and Analyzed Sample

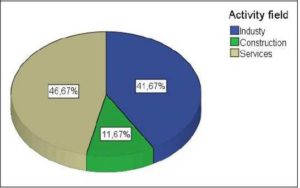

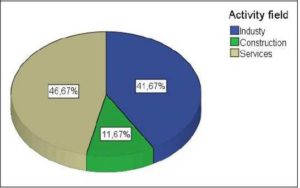

In this study, the target (studied) population consists of the companies quoted in the Bucharest Stock Exchange, and the selection of the stratification criterion took into account the weight of the activity field in obtaining Romania’s gross domestic product (GDP), for the first quarter of 2011. Therefore, this criterion ensured the representative nature of the analyzed sample: the number of companies in a certain activity field is directly proportional with the weight specific to each field in the resulting GDP. The analyzed sample includes 60 companies quoted in the BSE, and its structure according to the activity field of the companies is represented in Figure 1.

Fig. 1. Structure of the Extracted Sample According to the Activity Field of the Companies Quoted in the BSE

(Source: own processing in SPSS 19.0)

In each activity category, the companies were randomly selected from the suggested sample pool.

Analyzed Variables and Data Source

The objectives of the research and the validation of the work hypotheses are the analysis and evaluation of the analyzed phenomenon by modeling it using result (dependent) variables and the influences generated upon them by a series of factor (independent) variables. The set of considered variables is synthesized in the following table:

Table 1. Analyzed Variables

(Source: own processing)

In order to estimate the degree of influence of the activity field on the financial leverage, dummy variables will be used, with the field of services being the reference field for building them.

Data collection considers the financial statements of the companies quoted in the BSE corresponding to the fiscal year 2010, presented on the Web site: http:/bvb.ro.

Date Analysis Methods

Meeting the research objectives and validating the work hypotheses have imposed using consecrated data analysis methods, the most often used of which being: the ratio analysis, the multiple linear regression analysis and the linear regression analysis with ANCOVA independent alternative variables.

Specific to financial analysis, ratio analysis is an analysis method consisting of computing and interpreting indexes determined by reporting items or item sets in the financial statements corresponding to the same fiscal year, in order to evaluate the status of a company (Mironiuc, 2006).

The study of the connections established among a series of independent variables (factors) and a dependent (result) variable as well as establishing the laws that govern these connections (estimation of the mathematical relation) are done using the multiple linear regression analysis (Jaba, 2002). The relations between the dependent and independent variables can be generally expressed by a function of the type: Y = f (X1, X2, …, Xn) + ε, where Y is the result variable, and Xi, i=1..n, is the factor variable.

Thus, considering the stated work hypotheses, based on this method, the researchers suggest the estimation of the regression coefficients for the following two models:

- BVpSH = β0 + β1RAFG + β2RIT + β3RITS + β4RDC + β5ln(RDD), for the first hypothesis;

- LF = γ0 + γ1ROA + γ2RAFG + γ3RAI + γ4CR, for the second hypothesis, without taking into account the influence of the activity field.

The identification and quantification of the connections established between a dependent variable and linear combinations of alternative qualitative variables with scale numeric variables are based on the multiple linear regression analysis with independent alternative and numeric variables. Known in specialized literature as ANCOVA, this type of analysis aims to test the influence of a qualitative variable (in this case, the activity field) on the result variable (financial leverage). This model can be obtained by using alternative (dummy) variables resulting from transforming the qualitative criterion (activity field), in a number of k new dummy variables (k = number of characteristics -1). In this case, 2 new dummy variables will be obtained, with the reference field established being that of services. Generally (Gujarati, 2004), the regression equation will be of the type: Y = γ0 + γ1D1X1 + γ2D2X2 + ε. Therefore, in order to validate the second work hypothesis, the researchers suggest estimating the parameters of the following mathematical model:

- ln(LF) = γ0 + γ1ROA + γ2RAFG + γ3RAI + γ4ln(CR) + γ5D1ROA + γ6D1RAFG + γ7D1RAI + γ8D1ln(CR) + γ9D2ROA + γ10D2RAFG + γ11D2RAI + γ12D2ln(CR), with D1 the dummy variable associated to the industry activity field and D2 the dummy variable associated to the commerce activity field.

Work Instruments

Data analysis with the suggested methods took into account the use of dedicated software, the statistical programs SPSS 19.00 and AMOS 16.0. For an easy representation and understanding of the causes indentified in the second work hypothesis, AMOS 16.0 was used.

Results and Discussions

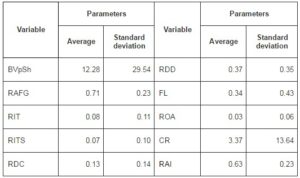

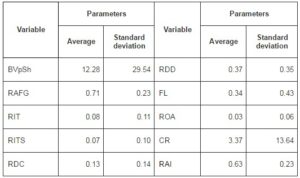

The study regarding the way in which the financing strategy (synthesized by the financial ratios suggested in the model) acts upon the company’s value and the identification of the factors that influence the choice of the financing structure of the company required a descriptive analysis, by knowing the parameters (average and standard deviation). Table 2 synthesizes these descriptive statistics, on which subsequent estimations will be based.

Table 2. Descriptive Statistics

(Source: own processing in SPSS 19.0)

Based on the results synthesized in the table above, it can be noticed that, at the level of the analyzed sample, a company whose value (per share) is on the average 12.28 ron is characterized by a low degree of indebtedness, both on the short term (7%) and on the long term (8%). Thus, the high degree of financial autonomy (over 70%) is stressed, which characterizes the companies quoted on the Romanian stock exchange market, and this is the effect of the adoption of a policy that minimizes the risks caused by funding through credits.

The dividend distribution ratio, 37% on the average, reflects the companies’ concern with reinvesting the profit obtained (63% on the average) in order to continue developing their business, as a specific objective of majority shareholders as well as with confirming the expectations of the minority shareholders, who count on obtaining benefits in exchange for the invested capital from dividends.

At the level of the sample in this study, the immediate liquidity ratio is noticed, which reflects the ability of the company to pay its short-term debts based on their available cash, whose volume (over 300%) suggests an inappropriate management of the company’s liquidity, which generates opportunity costs determined by not using these resources efficiently.

The analyzed companies have a significant fixed assets ratio, over 60% on the average, which, in the conditions of the general decrease of the sales figure, signals an increase in the companies’ rigidity, respectively a low degree of their adaptation to the market conditions. This will be fully reflected upon the performance of the basic activity. There can be seen, therefore, a very small value of economic profitability (3% on the average), determined both by the inefficiency of the operational activity and by the usage of fixed assets as internal factors, and by the general decrease of the economic activity that characterizes the current period, but with a significant impact on the process of obtaining future financial resources.

Knowing the connections established at the level of the previously presented indicators, using the multiple linear regression analysis, has led to the estimation of the coefficients of the suggested mathematical model for the first work hypothesis. Moreover, the identified model (linear combination) accounts for over 30% of the variance of the value of a share, based on the results obtained using SPSS concerning the determination ratio (R2) and of the significance degree (Sig < 0). After analyzing the data for the sample, the researchers estimate, with a probability of 95%, the parameters of the suggested model for the first work hypothesis, through the results below:

BVpSH = 8.32RAFG -4.53RIT -3.94RITS -5.24RDC + 0.22ln(RDD)

The results estimated in the model above indicate, with a confidence of 95%, that the term indebtedness ratio, the short-term indebtedness ratio and the commercial debt ratio have a negative influence on the value of a share, while the financial autonomy ratio and the dividend distribution ratio have a positive influence, the sign of the influences being stressed by the sign of the associated coefficients. Therefore, an increase by one percent of the financial autonomy ratio determines on the average an increase in the value of one share by 8.32 percent and a logarithmic increase of the dividend distribution ratio by one unit determines an increase of the average value of one share by 0.22 percent. The use of the logarithm is strictly based on a statistical reasoning, which determines a normal distribution corresponding to DDR. In what concerns the indebtedness ratios, it can be noticed that an increase by one percent of the term indebtedness ratio, of the short-term indebtedness ratio or of the commercial debt ratio determines, in turn, a decrease of the value of the company, on the average, by 4.53%, 3.94% or by 5.24%.

An analysis of the coefficients in the suggested regression model shows that an increase in the degree of financial autonomy (financing based on own resources, based either on the reported result or on the new income) determines a significant increase of the value of one share; this financing method significantly contributing to value creation and implicitly to the company’s development. This situation reflects the closeness of the financing method used by the analyzed companies to the percepts of the pecking order theory, according to which the provision of the resources necessary to perform the activity mainly takes place by resorting to internally generated funds and only in the second place to debts. This way, a preservation of the decision-making ability and a minimization of the generated financial risk, especially by resorting to bank credits, are considered to be achieved.

In this context, financing of investment projects as well as of a part of the operational cycle is mainly achieved through own funds; an increase of the short and long-term indebtedness level being associated with a decrease of the company’s value. Therefore, a financial strategy exclusively based on foreign resources (on financial or commercial debts), in the conditions in which they are not counter-balanced by an investment plan (for update or development), which would generate cash flows, determines a significant reduction of the company’s value. This is due to the high level of the interest rate for the credits that may be contracted, which cannot be exceeded by the economic profitability ratio. This way, a negative financial leverage is generated, which erodes the performance of the operational activity and implicitly that of the financial profitability, all of which have a negative impact on the companies’ value.

In what concerns the dividend distribution ratio, the researchers can state that although it has quite a low impact on the company’s value, it indicates the strategic tendencies regarding the development objectives of the companies as well as the dividend policy adopted in order to meet the minority shareholders’ expectations. It can be observed, however, that companies that distribute dividends may rely on an increase of their own value 0.22%, which, together with the effect generated by the profit reinvestment ratio, reflects the existence of an increased degree of confidence of the investors in the stock market, in general, and in the quoted companies in particular.

In respect to the level of liquidity that a company owns at a certain moment, it provides a high degree of financial safety, especially to the honor of the current creditors (short-term commercial or financial debts), with direct implications on solvency, on the continuation of the activity, and on preserving reliability.

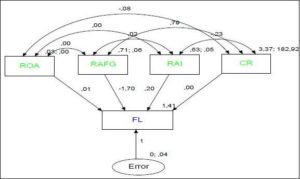

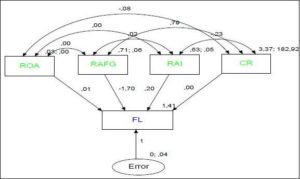

The factors presented above, which help explaining the variation of the company’s value, are exponents of the financing strategy selected by the company. However, knowing the causes that determined the choice of such a financing strategy and implicitly of the financial structure can be possible with the help of the suggested model, analyzed in AMOS 16, which aims to identify the significant factors and to evaluate their influence on the financial leverage as an indicator of the financial structure of the company.

Therefore, figure 2 is concerned with just a series of financial factors for determining their influence on the ratio between the total financial debts and of the shareholders’ equity. In order to test any possible colinearities, the correlating coefficients have been also computed at the level of the independent variables.

Fig. 2. Estimations of the Parameters of the Regression Model for the Second Work Hypothesis

(Source: own processing in AMOS 16.0)

The results synthesized in figure 2 show that the ratio between the shareholders’ equity and the total capitals made available for the company has a significant impact on the financial structure, irrespective of their source. The increase of the financial autonomy (by one percent) directly implies a reduction of the financial leverage by 1.70%. Although shareholders’ resources contribute decisively to the existence of fixed assets, the performed analysis leads to the conclusion that an increase in the degree of intangibility by one percent determines an increase in the degree of indebtedness by 0.20%. Therefore, an investment or update policy that considers the acquisition of tools, work plants, etc. cannot be supported exclusively by the company’s own resources, and contracting debts is, in this case, necessary.

The desire to improve the company’s performance, through high values of economic profitability, has a significant impact on the financial leverage. An increase by one percent of the ROA implies an increase by 0.10% of the FL, if the values of the other factors remain constant. Therefore, obtaining considerable operational results allows compensating for the costs of debt, by stimulating the investment activity mainly performed based on the financial support provided by foreign creditors. In what concerns the cash ratio, it can be noticed, for the analyzed sample, that it does not have any significant influence on the financial leverage.

The regression equation obtained based on the indicators above and presented in figure 2 can be synthesized in the model below, which explains over 73.8% of the variance of the financial leverage, as follows:

LF = 1.41 + 0.10ROA -1.70RAFG + 0.20RAI + 0.00CR.

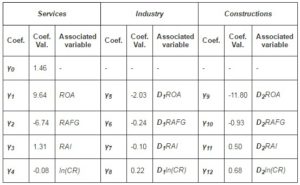

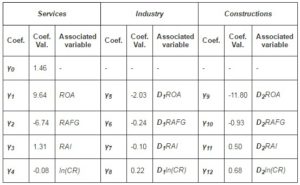

In order to estimate the influence of the financial indicators on activity fields (corroborated effect) and on the financial structure (financial leverage), alternative qualitative variables will be used, integrated in the model above, according to the results presented in table 3.

Table 3. Parameters of the ANCOVA Model Corresponding to the Second Hypothesis

* independent variable: ln(FL)

* independent variable: ln(FL)

(Source: own processing in SPSS 19.0)

The equation of the regression model, obtained after compounding the financial indicators with the dummy variables corresponding to the activity field will have the form:

ln(LF) = γ0 + γ1ROA + γ2RAFG + γ3RAI + γ4ln(CR) + γ5D1ROA + γ6D1RAFG + γ7D1RAI + γ8D1ln(CR) + γ9D2ROA + γ10D2RAFG + γ11D2RAI + γ12D2ln(CR).

Therefore, for the field of services, an increase by one percent of ROA will determine an increase by 9.64% of the financial leverage, compared to an additional drop by 2.03% for the companies in industry and an additional drop by 11.8% for the companies in the field of services. Moreover, in what concerns RAFG, its increase by one percent will trigger a significant drop (the highest) of the leverage for the companies in constructions (by 0.93% in addition to the field of services) and only -0.24% in addition to the companies in industry, compared to those in services. At the level of the fixed assets, an increase in the value of RAI by one percent will determine an increase of the degree of indebtedness by 1.31% for the companies in services, compared to an increase of only 1.21% (1.31-0.10) for the companies in industry and 1.81% (1.31 + 0.50) for the companies in constructions. By synthesizing, a discrimination is noticed in what concerns the influence of the financial factors on the financial leverage, on activity fields, that occurred as follows: ROA determines an increase in the FL for the companies in services and a decrease for the companies in the other activity fields, an increase in RAFG contributes the most to the decrease of the degree of indebtedness for the companies in constructions, RAI implies the highest increase of FL for the companies in constructions, and the logarithmic increase in the cash ratio contributes to a significant increase in FL for the companies in constructions, compared to the companies in services (which are characterized by a diminution in the FL).

Conclusions

Generated by the need to make decisions concerning the purchase or investment in new economic entities, in conditions of correct and detailed information on their status and perspectives of economical development, due diligence identifies ever stronger its role and meaning. Knowing the impact generated by the funding strategy on the value of the companies, as well as the triggers involved in the process of shaping the financial structure are essential elements that contribute to the success of such an approach.

The complexity of the due diligence process comes from the difficulty to establish precisely a real value of the analyzed company, according to a series of financial and non-financial factors. Therefore, the validation of the work hypotheses (H1 and H2) has lead to obtaining useful econometric models for auditors in estimating the influence of the financing strategy on the company’s value, as well as in the identification and quantification of the influence of financial and non-financial factors on the degree of indebtedness. Knowing the determining factors and the way they influence the financial structure implies a better evaluation of the company’s value, based on which an appropriate price will be set corresponding to the acquisition or sale.

This study notices, for the analyzed sample, the direct and positive connections established between the financial autonomy ratio and the dividend distribution ratio, on the one hand, and the company’s value on the other. A reverse, negative connection can be noticed between the term indebtedness ratio, the short-term indebtedness ratio, the commercial liabilities ratio and the dependent variable represented by the mathematical value of a share. At the same time, from the performed analysis the triggers can be observed (economic profitability, global financial autonomy ratio, fixed assets ratio, immediate liquidity) that lie at the basis of coagulating the financial structure, stressing their relations and intensity upon the financial leverage, as indicators of the capital composition.

At the same time, this paper introduces into the analysis the influence of the specificity of the performed activity on the degree of indebtedness, thus reflecting the need to evaluate the relevance of the funding strategies according to the activity field of the companies. This stresses the influence, in various values and senses per activity field (industry, constructions and services), of the analyzed independent variables on financial leverage. From this point of view, ROA determines an increase in the FL for the companies in services and a decrease for the companies in the other activity fields, an increase in RAFG contributes the most to the decrease of the degree of indebtedness for the companies in constructions, RAI implies the highest increase of FL for the companies in constructions, and the logarithmic increase in the cash ratio contributes to a significant increase in FL for the companies in constructions, compared to the companies in services.

The quantitative approach (rounded by logical positivism, which lied at the basis of the deductive-inductive scientific approach) significantly contributes to improving due diligence by suggesting empirical models that will support the author’s opinion concerning the opportunity of the decision to invest.

Subsequent developments concern obtaining functions that would achieve classifications of companies into distinct performance groups, based on the value of the company, or obtaining functions for determining the probabilities to include them in a certain category.

In order to minimize the limitations of the study, the extension of the sample volume should be considered, by introducing other activity fields or by including other non-financial factors.

Acknowledgements

This work was supported by the European Social Fund in Romania, under the responsibility of the Managing Authority for the Sectorial Operational Program for Human Resources Development 2007-2013 [grant POSDRU/CPP 107/DMI 1.5/S/78342].

(adsbygoogle = window.adsbygoogle || []).push({});

References

Adams, M. B. (1994). “Agency Theory and the Internal Audit,” Managerial Auditing Journal, 9(8), 8-12.

Publisher – Google Scholar – British Library Direct

Aggarwal, R. & Kyaw, N. A. (2010). “Capital Structure, Dividend Policy, and Multinationality: Theory Versus Empirical Evidence,” International Review of Financial Analysis, 19, 140–150.

Publisher – Google Scholar

Ayyagari, M., Demirgüç-Kunt, A. & Maksimovic, V. (2007). “Formal Versus Informal Finance: Evidence from China,” Working Paper 4465, World Bank, retrieved 17.07.2011,http://unpan1.un.org/intradoc/groups/public/documents/apcity/unpan035848.pdf.

Publisher

Berger, A. N. & Bonaccorsi di Patti, E. (2006). “Capital Structure and Firm Performance: A New Approach to Testing Agency Theory and an Application to the Banking Industry,” Journal of Banking & Finance, 30, 1065–1102.

Publisher – Google Scholar

Carp, M. (2011). ‘Teoriile Privind Dimensionarea Structurii Financiare – Suport Decizional in Managementul Financiar,’ In Cercetarea Doctorala in Economie: Prezent Si Perspective, Alexandru Ioan Cuza University, Iaşi, June 24-25.

Chang, C., Lee, A. C. & Lee, C. F. (2009). “Determinants of Capital Structure Choice: A Structural Equation Modeling Approach,” The Quarterly Review of Economics and Finance, 49, 197–213.

Publisher – Google Scholar

De Jong, A., Kabir, R. & Nguyen, T. T. (2008). “Capital Structure Around the World: The Roles of Firm- and Country-Specific Determinants,” Journal of Banking & Finance, 32, 1954–1969.

Publisher – Google Scholar

Delcoure, N. (2007). “The Determinants of Capital Structure in Transitional Economies,” International Review of Economics and Finance, 16, 400–415.

Publisher – Google Scholar

Du, J. & Girma, S. (2007). “Does the Source of Finance Matter for Firm Growth? Evidence from China,” Research Papers Series, University of Nottingham, Retrieved 15.07.2011, http://ideas.repec.org/p/not/notgep/07-39.html.

Publisher

Emerald Article (2004). “Getting Growth Right: How Due Diligence Aids Successful Mergers,” Strategic Direction, 20(10), 11-14.

Publisher

Frank, M. Z. & Goyal, F. K. (2008). “Trade-off and Pecking Order Theories of Debt,” The Handbook of Corporate Finance, 2, 135–202.

Publisher – Google Scholar

Gujarati, D. (2004). ‘Basic Econometrics,’ The Mcgraw-Hill Companies, New York.

Hayes, R., Dassen, R., Schilder, A. & Wallage, P. (2005) ‘Principles of Auditing: an Introduction to International Standards on Auditing,’ Pearson Education, Essex.

Google Scholar

Hennessy, C. A. & Whited, T. M. (2005). “Debt Dynamics,” Journal of Finance, 60, 1129–1165.

Publisher – Google Scholar

International Accounting Standards Board (2011). IAS 1 – ‘Presentation of Financial Statements,’ retrieved 11.07.2011,http://ec.europa.eu/internal_market/accounting/docs/consolidated/ias1_en.pdf.

Publisher

Jaba, E. (2002). Statistica, Economică, Bucureşti.

Karadeniz, E., Kandir, S. Y., Balcilar, M. & Onal, Y. B. (2009). “Determinants of Capital Structure: Evidence from Turkish Lodging Companies,” International Journal of Contemporary Hospitality Management, 21(5), 594-609.

Publisher – Google Scholar

Koller, T., Goedhart, M. & Wessels, D. (2010). ‘Valuation: Measuring and Managing the Value of Companies,’ John Wiley & Sons Ltd., Hoboken.

Publisher – Google Scholar

La Rocca, M., La Rocca, T., Gerace, D. & Smark, C. (2009). “Effect of Diversification on Capital Structure,” Accounting and Finance, 49, 799–826.

Publisher – Google Scholar

Lin, J. Y., Sun, X. & Jiang, Y. (2009). “Toward a Theory of Optimal Financial Structure,” Working Paper 5038, World Bank, retrieved 14.07.2011, http://ideas.repec.org/p/wbk/wbrwps/5038.html.

Publisher

McGee, J. A. & Byington, R. (2009). “Due Diligence Issues in China,” Wiley InterScience, retrieved 11.07.2011, www.interscience.wiley.com.

Publisher – Google Scholar

Mironiuc, M. (2006). ‘Analiză Economico-Financiară.Elemente Teoretico-Metodologice Şi Aplicaţii,’ Sedcom Libris, Iaşi.

Google Scholar

Mironiuc, M. (2007). ‘Gestiunea Financiar-Contabilă a Întreprinderii: Concept, Politici, Practici,’ Sedcom Libris, Iaşi.

Google Scholar

Mironiuc, M. (2009). ‘Fundamentele Ştiinţifice Ale Gestiunii Financiar-Contabile a Întreprinderii,’ Al. I. Cuza, Iași.

Google Scholar

Mironiuc, M., Carp, M. & Robu, I. B. (2011). ‘The Relevance of Company Evaluation Methods in Conditions of Economic Instability. Empirical Study on the Companies Quoted in the Bucharest Stock Exchange,’ Proceedings of the International Conference Accounting and Management Information Systems (AMIS) 8-9 June 2011, Bucharest, Romania, ISSN 2247 – 6245, 183-200.

Modigliani, F. & Miller, M. H. (1958). “The Cost of Capital, Corporation Finance and the Theory of Investment,” American Economic Review, 48, 261-97.

Publisher – Google Scholar

Morrison, N. J., Kinley, G. & Ficery, K. L. (2008). “Merger Deal Breakers: When Operational Due Diligence Exposes Risk,” Journal of Business Strategy, 29, 23-28.

Publisher – Google Scholar – British Library Direct

Myers, S. C. & Majluf, N. S. (1984). “Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have,” Journal of Financial Economics, 13 (2), 187-221.

Publisher – Google Scholar

O’Regan, D. (2004). ‘Auditor’s Dictionary. Terms, Concepts, Processes, and Regulations,’ John Wiley & Sons, New Jersey.

Google Scholar

Philosophov, L. V. & Philosophov, V. L. (2005). “Optimization of a Firm’s Capital Structure: A Quantitative Approach Based on a Probabilistic Prognosis of Risk and Time of Bankruptcy,” International Review of Financial Analysis, 14, 191–209.

Publisher – Google Scholar

Rahaman, M. M. (2011). “Access to Financing and Firm Growth,” Journal of Banking & Finance, 35, 709-723.

Publisher – Google Scholar

Rebel, C. (2008). “What Do We Know About the Capital Structure of Privately Held Firms? Evidence from the Surveys of Small Business Finance,” Working Paper, Depaul University Chicago, Retrieved 10.07.2011, http://mpra.ub.uni-muenchen.de/24669/.

Publisher

Smith, G. P. (2010). “What Are the Capital Structure Determinants for Tax-Exempt Organizations?,” The Financial Review, 45, 845–872.

Publisher – Google Scholar

Smith, M. (2003). “Research Methods in Accounting,” SAGE Publications, London.

Publisher

Spedding, S. L. (2008). ‘The Due Diligence Handbook: Corporate Governance, Risk Management and Business Planning, ‘CIMA Publishing Elservier, Burlington.

Publisher – Google Scholar

Vernimmen, P., Quiry, P. & Le Fur, Y. (2005). “Corporate Finance.Theory and Practice,” John Wiley & Sons Ltd., Chichester.

Publisher – Google Scholar

Viviani, J. L. (2008). “Capital Structure Determinants: An Empirical Study of French Companies in the Wine Industry,” International Journal of Wine Business Research, 20(2), 171-194.

Publisher – Google Scholar – British Library Direct